Manufacturers today consider much more than the initial purchase price of a piece of equipment before making an investment. They require their vendors to supply, not just an initial purchase price, but also a complete analysis of the cost of the equipment over time.

Today’s savvy manufacturing companies know that the most important number to pay attention to is the total cost of ownership or TCO, which is defined as the direct and indirect costs related to the equipment for the lifetime of that product. Here’s more information about this:

Why Total Cost of Ownership?

TCO has become a major differentiator from one product to the next. TCO is increasingly the deciding factor for driving manufacturing purchase decisions. Vendors to these global manufacturing entities are better able to assimilate the customer supplied data, analyze it and present in a way that is easy, understandable and ultimately supports the decision.

As the relationship between end user and a valued vendor progresses, it is important to provide these end user customers with knowledge of their industry and how a vendor’s products benefit that industry specific to their needs. The application of this knowledge is used to continually improve the end user’s productivity and increase the asset life cycle of the vendor’s equipment.

TCO and Fluid Dispensing

In the case of fluid dispensing, for so many years, the pneumatic dispenser was purchased over air free/ positive displacement dispensing because of its’ low initial purchase price. In cases where manufacturers required better repeatability, they were willing to pay a bit more for an air free positive displacement system. The repeatability of the fluid deposit is a valid consideration and the initial price is simply the starting cost of the system to the end user. Interestingly, as Total Cost of Ownership became part of the evaluation, these better, more repeatable air free systems proved to be more economical over time.

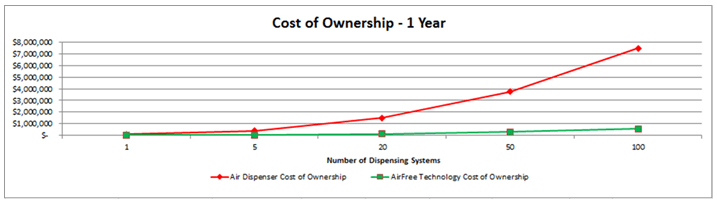

As manufacturers started to use TCO as part of the decision-making process, they used their own data to show that pneumatic systems were a huge part of an out of control process, driving scrap rates, energy costs, maintenance costs and labor costs much higher. The graph below outlines the difference in Total Cost of Ownership between dispensers using air (air dispenser) and dispensers using no air or AirFree® technology (AirFree® dispenser).

TCO and New Product Lines

Committing a new production line to a single air dispenser locks that production line into future unrealized losses as the business grows as represented by the red line above. If a company commits to a single AirFree® dispenser, in addition to the immediate savings, as the production line grows the Total Cost of Ownership remains low adding hundreds of thousands if not millions to the bottom line as represented by the green line above. Changing out 10 air dispensers for 10 Fishman AirFree® dispensers provides an immediate savings as represented by the gap between the red and green line above.

Over the life span of an assembled product the savings become even more significant. Also as more and more AirFree® dispensers are installed, a manufacturer’s air compressor consumption drops which in turn reduces its carbon footprint as air compressors are the most expensive energy consumer in a production facility as well as a major contributor to greenhouse gasses.

Choosing AirFree® technology over pneumatics results in an inexpensive cost of ownership dropping hundreds of thousands, if not millions, of dollars to the bottom line thereby providing a healthy return on investment on the SmartDispenser® purchase. Fishman would welcome the opportunity to discuss return on investment, cost of ownership or our Green initiative in greater detail. Contact Fishman Corporation for more information about this.